The Best Mortgage Strategy for Alberta Buyers in 2026

If you are buying in Alberta in 2026, you are entering one of the strongest housing markets in Canada. Lower home prices compared to BC and Ontario. A booming job market. Expanding communities in Calgary, Edmonton, and vibrant secondary markets.

But one major decision still stands in your way.

Should you lock in your rate or go variable?

At Merge Mortgage Group, we are having this conversation daily with clients relocating to Alberta, investing in rental properties, or buying their first home here. Let’s break it down in a way that actually makes sense.

Why Alberta Buyers Are in a Unique Position

Alberta continues to attract buyers from across Canada because of:

Lower purchase prices

No provincial sales tax

Strong job growth

New communities with long term upside

Because entry prices are lower, many Alberta buyers have more flexibility in their monthly budget. That flexibility can influence whether fixed or variable is the right move.

Fixed Rate Mortgages in 2026

A fixed rate locks your interest rate for the full term. Your payment stays consistent.

Why Alberta buyers choose fixed:

Predictable monthly costs

Protection if rates increase

Easier budgeting for growing families

This is especially attractive for newcomers to Canada settling in Alberta or families relocating from higher priced provinces who want financial stability in their transition.

Variable Rate Mortgages in 2026

Variable rates move with prime. If the Bank of Canada cuts rates, your interest cost drops.

Why some Alberta buyers are leaning variable:

Expectations of gradual rate easing

Greater flexibility if selling or refinancing

Historically lower long term interest costs

For investors purchasing rental properties in Calgary or Edmonton, variable can offer flexibility and potential long term savings. For buyers building new homes in expanding communities, it can also provide strategic breathing room.

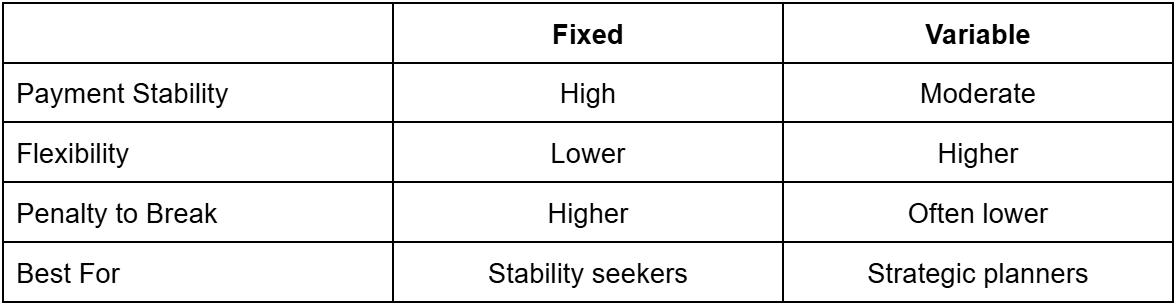

Fixed vs Variable Comparison

What Is Smart in Alberta Right Now

Because Alberta home prices remain more accessible, many clients can qualify comfortably even if rates fluctuate slightly. That makes variable an attractive option for buyers with higher risk tolerance.

However, if you are relocating from BC or Ontario and adjusting to a new job or income structure, locking in may offer the stability you need during that transition.

There is no one size fits all strategy. At Merge Mortgage Group, we model both scenarios so you can see:

What happens if rates drop

What happens if rates stay flat

What happens if rates increase

That clarity allows you to move forward confidently.

Thinking About the Bigger Picture

Your mortgage strategy should align with your long term Alberta plan.

Are you:

Building a home

Buying a rental

Purchasing for a family member

Consolidating debt into your new mortgage

Each scenario changes the conversation.

Alberta offers opportunity. Your mortgage strategy should support that opportunity, not limit it.

The 2026 Bottom Line

-If you value stability above all else, fixed delivers certainty.

-If you can tolerate short term fluctuations for potential savings, variable deserves serious consideration.

The best move is not guessing. It is planning.

Visit mergemortgage.ca to connect with our team. We will walk you through your options and build a strategy tailored to your Alberta goals.

📍Serving Alberta, BC, and Ontario

🌐 mergemortgage.ca